If one of your health plan participants recently underwent surgery, visited an emergency room, or stayed in the hospital, chances are good your plan and member have been overcharged for the care. Chances are good as well that no one noticed or knew how to spot the unfair billing.

Every day unions and employers use our company to review medical bills for accuracy and fairness. We often find billing errors, greed, and fraud. For example, a podiatrist in New York elected to use an assistant surgeon for two common surgeries on a patient. That assistant surgeon alone billed $169,410. Fair payment for the assistant as determined by our surgeon review was $632.

In another case we reviewed, a police officer suffered a severe open fracture of his heel bone in the line of duty. The hospital bill for 20 days came to $761,464. After WellRithms’ review and repricing, the hospital accepted payment of $187,782.

Billing errors and abuse often go unnoticed but can quickly add up. Research published in the JAMA Open Network in 2019 found medical pricing irregularities, fraud, and abuse could cost between $289 billion and $324 billion annually. This is more than New York’s entire 2024 state budget of $229 billion.

When your plan and participants are overbilled by hospitals and doctors, you pay twice – once when you pay the bill and again when your skyrocketing health benefit premiums cut into your wages and other benefits.

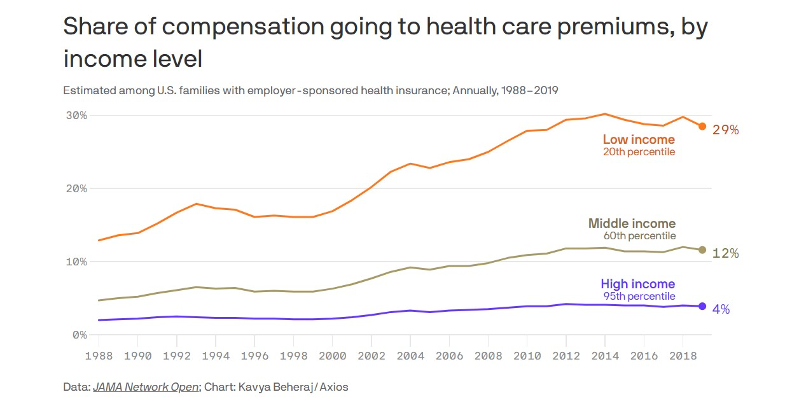

The share of total employee compensation going to health care premiums among American workers is growing fast. Researchers at Tufts University found it rose from 7.9% in 1988 to 17.7% in 2019. Lower-income workers are hit the hardest, with 29% of their compensation going for health benefits. That’s money that could be going to paychecks.

There are a lot of reasons for this huge price increase, but among those reasons are healthcare systems and unscrupulous doctors manipulate billing through coding and other schemes that inflate your medical bills.

How Can You Protect Yourself and Your Plan?

You might think your health insurance company would review your medical bills for accuracy and fairness. They don’t. But we do. And we usually find millions of dollars in savings for our clients every year.

Unions around the country have taken legal action to hold their health insurers accountable as stewards of their plans. These include suits by the International Union of Bricklayers and Allied Craftworkers Local 1 Connecticut Health Fund and the Massachusetts Laborers’ Health and Welfare Fund, among others. Outside of legal action you can protect your plan and members by taking the following steps:

1. Insist on getting your plan’s data so you can review it.

2. Work with a bill review and repricing company that has expert technology for reviewing claims, physicians who know how to spot billing gimmicks, and actual provider cost data for legally defensible claims repricing – before you pay the bills, not after.

3. Ask if that firm has enough confidence in their repricing that they’re willing to stand behind it with a total savings guarantee that protects your plan and members from future legal and financial maneuvers by the medical networks.

WellRithms provides these services to employer groups, guilds, and unions, including various building trades nationwide. Our Shield Indemnification™ service, meanwhile, protects patients from balance billing attempts and collection agencies.

When multi-billion-dollar health networks are looking to skim that kind of money from your plan and participants, you need a partner with the medical, technical, and legal expertise to not back down from protecting what’s yours. It’s your money. You earned it. We can help you keep it.

Charles Greenawalt is the Vice President of Sales at WellRithms, bringing over 15 years of experience in healthcare. He has experience working with organizations in the Group Health, Workers’ Compensation, Auto, and Taft-Hartley markets. This experience has given him a broad perspective of the healthcare industry and the inner workings of each organization.

Kevin Renner, has worked with two Blue Cross Blue Shield plans, and has held administrative roles with a major academic medical center, a regional hospital system, and a federally qualified health center.